Summary

Unless you've been living in a van down by the river, you know that the first quarter of 2020 was...overwhelming.

January started off well: Investors were feeling good about the stellar year that was 2019, financial markets continued to hit all-time highs, and unemployment was low. However, during the early weeks of 2020 it became clear that COVID-19 was turning into a serious global pandemic. Financial markets peaked on or around February 19, and then fell quickly and severely. Since then, investors have experienced swings in financial markets nearly every day, with double-digit rebounds in most stock indices.

As if a global pandemic wasn't enough, the price of oil cratered due to a price war, which only exacerbated the ups and downs in financial markets.

First Quarter 2020 Numbers

The average diversified U.S. stock fund, which is a better measure of how we invest than the S&P 500 or the Dow, lost nearly 25% during the first quarter. Investors, justifiably spooked, pulled $89 billion from US stock funds.

Returns for international stocks were also negative, with the average diversified international stock fund down 23%. Surprisingly, investors sent nearly $7 billion into international stocks funds during the quarter.

The average intermediate-term bond fund gained 0.4% during the first quarter. In a flight to safety, investors pulled $160 billion from bonds in favor of cash and gold.

This does not mean you should run out and buy gold.

Unmarked Hazards Exist

In mid-January, I was fortunate to go snowboarding in Taos, New Mexico. While on the mountain, I saw signs everywhere reminding boarders and skiers that "unmarked hazards exist". That's because snow and bad weather can hide rocks, holes, and numerous other hazards.

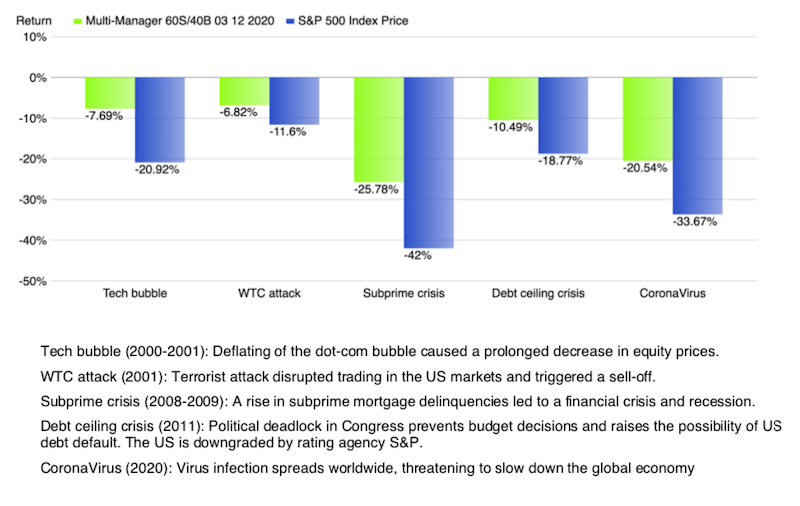

The chart above is a good reminder about unmarked hazards. The chart shows five major hazards that have disrupted financial markets over the last 20 years. The CoronaVirus hazard was recently added, after replacing the Long-Term Capital Management (LTCM) hedge fund bailout of 1998.

In hindsight, it's easy to say that most of the hazards shown above were obvious. After 2001 it was obvious to everyone that tech stocks had been wildly overvalued. After 2009 it was obvious to everyone that the combination of a housing bubble and sub-prime lending had caused a financial crisis.

I suppose one could argue that some hazards are expected. For example, public health officials and other extremely intelligent people, such as Bill Gates, predicted a pandemic would occur and have a severe negative impact on the global economy. However, no one could predict exactly when a pandemic would occur or where it would begin.

Since the financial crisis of 2008-2009 investors have experienced a relatively smooth bull market. During that 10-year period I have sometimes shown the chart of hazards to clients when discussing their financial plan and investment allocation. My goal was twofold: First, to demonstrate how previous events have affected financial markets and client portfolios. Second, to reinforce the idea that another unknown event - not currently on the chart - would negatively affect markets sooner or later.

In other words, as investors, we have to accept that unmarked hazards exist. Something new, that's nearly impossible to plan or prepare for, will always come along to shake things up. The only thing we can do is create a plan and stick to it when the event finally occurs.

Where Do We Go From Here?

The movie 12 Monkeys is a great documentary about life in a post-pandemic world.

Uncertainty is always a problem, but it's a major one right now.

Everyone wants to know, among other things: How long will the pandemic last? How many deaths will there be? When can we resume our normal everyday routines? When will financial markets recover?

Unfortunately, no one can answer these questions right now. Given all of the bad news we're seeing every day, it's natural - and okay - to be nervous or unable to focus. I'm finding it difficult to focus when reading books or watching TV.

Since we're surrounded by so much uncertainty in these strange times, I recommend focusing on some positive things:

Using history as a guide, we know that financial markets will recover. The timeline for recovery may be different with every event, but it still happens. Your portfolio will recover, too.

If you are fortunate to be able to work from home during this pandemic, take a moment to think about how wonderful this is. Sure, you're stuck inside and your daily routine has been disrupted, but you are safe and you have income.

If you have children, being stuck inside with them can be challenging. However, this is a great opportunity to spend more time with your loved ones. Play some boardgames, do some puzzles, or watch some movies.

If you're stuck at home this is might be a good opportunity to work on home improvement projects you often don't have time for.

Stay home (if you can), wash your hands frequently, and stay healthy!