Navigating Market Volatility: Understanding the Impact of Tariffs and Trade Policy. This article examines the recent surge in trade tensions, exploring the historical context of tariffs, their impact on the US economy, the dollar, and inflation. Learn how investors can maintain perspective and focus on long-term goals amidst market fluctuations driven by trade policy headlines

Market Perspectives After a Nervous Start to 2025

The stock market has struggled in recent weeks as concerns have grown around interest rates, market valuations, the direction of the economy, and more. Since the market peak on December 6 last year, the S&P 500 has pulled back 4.3% while the 10-year Treasury yield has climbed from 4.15% to 4.76%.

This market decline reflects a natural adjustment as investors digest new economic data. The recent jobs report for December was stronger than expected, which means the economy may need less support from the Fed in the form of lower interest rates. At the moment, the market believes the Fed will cut rates just once in 2025, and that this may be the final cut of the cycle. However, these expectations can shift quickly, as they did throughout 2024.

Market volatility is normal and expected after two strong years

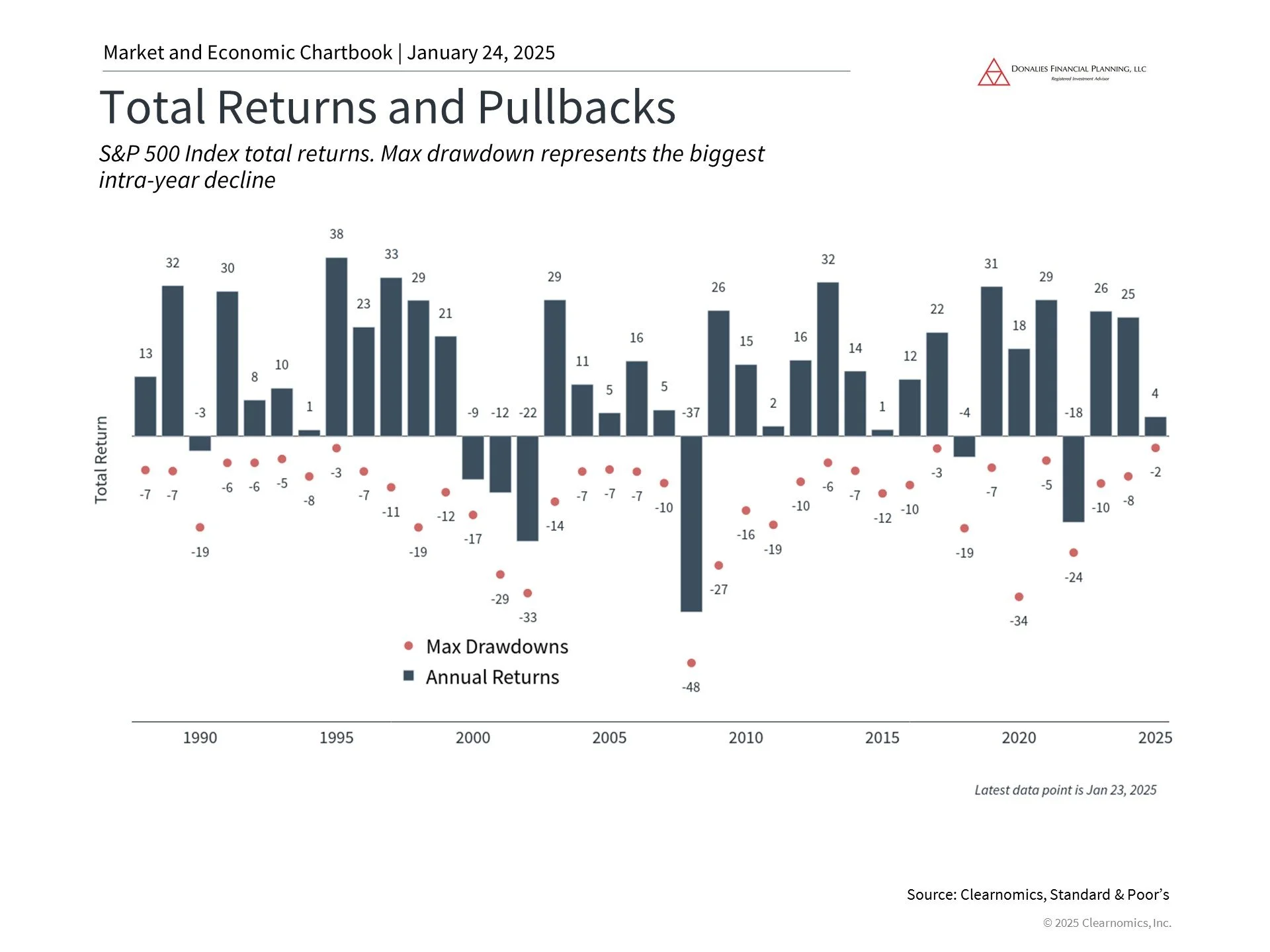

This chart shows total returns of the stock market (bars) and the largest intra-year decline (dots) each year. The average year sees a significant intra-year drop. However, most years still end in positive territory, especially with dividends.

This is where setting the right expectations is necessary. While market declines can be unsettling, it’s important to remember that there have only been a handful of trading days this year and a lot can happen in the coming months. Markets also began last year with a brief pullback that then gave way to a long rally. While the past is no guarantee of the future, long-term investors should not overreact to a few days of market uncertainty. If anything, this beginning-of-year volatility may present opportunities to review and rebalance portfolios according to long-term financial goals.

It’s important to keep in mind that markets have been relatively calm over the past two years as major indices have climbed to new record highs. As the accompanying chart shows, last year’s largest decline for the S&P 500 was only 8%, which is low by historical standards.

History shows that almost every year experiences several market pullbacks. Markets tend to recover quickly from these short-term declines, so trying to time them often backfires. This is why, for investors with longer time horizons, it’s often better to simply stay invested. Investors who stayed in the market over the past several years, despite the pandemic, inflation, Fed rate hikes, geopolitical conflicts, and other issues, have come out ahead

The Magnificent 7 have contributed meaningfully to market returns over the last three years. However, the Magnificent 7 have also been much more volatile. During the initial market pullback in 2022, the Magnificent 7 lost nearly half of their value. As such, volatile technology stocks play an important role in diversified portfolios, but are risky as standalone investments.

The Magnificent 7 have propelled U.S. stocks to new heights

Another concern among investors is whether the rally in technology and artificial intelligence stocks is sustainable. Investors often focus on the so-called “Magnificent 7” – seven technology stocks that have benefited from trends in AI. They have been at the heart of the broad market’s strong performance: as a group, these stocks have soared 250% since the beginning of 2023, and nearly 500% since 2020.

Despite the Magnificent 7’s rally and the ongoing importance of AI, investors should maintain a broader perspective. In 2022, during a period of rising rates and economic stress, technology and growth stocks were the hardest hit. This is because the value of these stocks depends greatly on expected earnings and cash flows far into the future. So, when interest rates go up, the value of these future cash flows can decline, leading to a setback in stock prices.

Another risk for investors is that, because the S&P 500 is weighted by the size of companies, stocks like Nvidia that outperform can become overweighted in investment portfolios. Investors may find that they are less diversified than they would like, or that their portfolios are far more sensitive to the movements of just a few stocks.

This is not a statement of whether the Magnificent 7 will or won’t continue to perform well. Instead, it’s a reminder that investing is not about making a few concentrated bets; it’s about constructing an appropriate portfolio that is aligned with long-term financial goals, ideally with the guidance of a trusted advisor.

Valuations are historically high

This PE ratio uses next-twelve-month earnings estimates, so it is forward rather than backward-looking. Valuations are no longer as attractive due to the market rally of the past year. Investors should properly diversify across asset classes, both in the U.S. and globally.

Perhaps the most significant difference investors face this year is that stock market valuations are well above average. As the accompanying chart shows, the price-to-earnings ratio for the S&P 500 is 21.5x, near its highest level in recent years and not far from the all-time peak of 24.5x during the dot-com bubble. In fact, some investors wonder if there is a market bubble today, or at least one in AI stocks.

A high price-to-earnings ratio means that investors are paying more for every dollar of earnings than in the past. This means that future returns may be lower, or equivalently, that markets have gotten ahead of future returns. The key question is whether the underlying economic and market fundamentals are healthy, or if the market rally is built on a house of cards as it was in 2000 or 2008. Today, the economy is still growing steadily, the job market is strong, and the companies with the most enthusiasm have robust earnings.

When valuations are high, the solution is not to avoid stocks altogether. Instead, it’s to stay balanced across different parts of the market that can outperform at different times. These might include sectors beyond Information Technology and Communication Services, and also investment styles such as value, small caps, or other uncorrelated opportunities. The key is to hold a portfolio that is appropriate for your specific financial goals.

The bottom line? While the stock market has struggled in recent weeks, investors should not overreact. Instead, it’s important to maintain a balanced portfolio that can withstand short-term uncertainty, while supporting long-term financial goals.

The Outcome of the 2024 Presidential Election and Investing

After a historic campaign, Donald Trump has won the 2024 presidential election and Republicans have won control of the Senate. For half the country, this is a cause for celebration, while for the other half, this is a disappointing result that will require time to process. This reflects the divisions in our country on both social and economic matters that we hope will heal in time.

The stock market has performed well across both parties

It’s clear that political outcomes can influence our daily lives and the direction of the country. However, regardless of which side of the aisle you’re on, history shows that the impact of politics on portfolios is often overstated. It’s important in the coming weeks to not overreact in either direction, but to instead keep a level head. Putting politics aside, what might this result mean for the economy and financial markets over the next four years?

From a broad perspective, history shows that the stock market and economy have performed well under both parties over the past century. In the coming weeks, there will likely be both bullish and bearish predictions. Some may expect a significant rally similar to the 2016 election, while others will expect issues like tariffs to slow the global economy.

When it comes down to it, long-term investors should continue to walk the line by staying invested, diversified, and focused on fundamentals. On the one hand, stock market valuations are already well above average, making it more important to be thoughtful when building portfolios, ideally with the guidance of a trusted advisor.

On the other hand, investors should also be wary of overly pessimistic views on the market. It's likely that predictions for market crashes have been made about every president in modern times. In recent years, it was certainly said about Obama in 2008, Trump in 2016, and Biden in 2020. Thus, it's important to separate personal and political feelings from financial plans and investments.

This is not to say that good policies don’t matter, but instead that business cycles are driven by factors beyond politics. What’s more, policy changes tend to be incremental, even when a President’s party controls Congress. History also shows that it is very difficult to predict how any particular policy might affect the economy and markets since stock prices adjust to new policies and companies adapt quickly as well.

The Tax Cuts and Jobs Act will likely be extended

Regarding taxes, a Republican Party victory makes it likely that much of the Tax Cuts and Jobs Act will be extended beyond its 2025 expiration. The TCJA overhauled the tax code for both individuals and businesses, including cutting corporate taxes to 21%, reducing many individual rates across tax brackets, lowering income taxes for many Americans, doubling the estate tax exemption, and more.

In addition, the uncertainty over these provisions during the election season made tax planning more complex. The expiration of the TCJA would create a potential “tax cliff” for many individuals and businesses. As a result, Roth IRA conversions, for instance, reportedly increased leading up to the election as individuals took advantage of current low tax rates.

It’s important to maintain perspective around tax policy since these issues can be politically charged. While taxes have a direct impact on households and companies, they do not always have a straightforward effect on the overall economy and stock market. This is because taxes are only one of the factors that influence growth and returns, and there are many deductions, credits, and strategies that can reduce the statutory tax rate.

The market has performed well across many tax regimes across history, including periods when the highest marginal rates were between 70% and 94% after World War II. Taxes today are low by historical standards. As the national debt grows, it’s prudent for investors to expect tax rates to eventually rise. Planning for this possibility is only growing in importance.

Tariffs and trade wars are back in focus

Looking at proposed policies, many investors worry that a second trade war could result from tariffs on major trading partners including China, the European Union, Mexico, and Canada. During his first term, President Trump increased duties on many goods including steel, aluminum, solar cells, washing machines, and more. On the campaign trail earlier this year, he proposed raising tariffs further, including up to 60% on China.

Unlike tax policy, which requires congressional approval, the president can impose tariffs through executive order. While many worry that this could harm the economy, analyzing tariffs can be complex. The Trump administration’s use of tariffs in 2018 and 2019 was often as a negotiating tactic, leading to a “Phase One” trade deal with China in early 2020. While the merits of the deal can be debated, the worst-case predictions for the economy and market never occurred.

In theory, tariffs can be inflationary since they increase the final costs of goods for consumers. Additionally, they run counter to long-held economic views that open trade creates mutual benefits for trading partners. However, they can also help to protect domestic industries from unfair trade practices, as well as secure intellectual property from theft and forced transfers.

The reality is that many tariffs imposed by the Trump administration were continued under President Biden. The current tariff proposals reflect the trends of de-globalization and protectionism that have emerged over the past decade. Once again, while tariffs and trade wars may impact certain industries and businesses, it’s important to not overreact with our portfolios.

Investors should focus on years and decades, not days and weeks

With the election now over, investors will shift their focus back to other economic considerations such as the Federal Reserve’s next rate decision, corporate earnings, and consumer spending. The fact that a significant source of uncertainty has been lifted could be enough to improve investor sentiment, as it has in past election seasons.

Ultimately, the business cycle is what has driven long run returns over the past century, and not two or four-year election cycles. These long-term business cycles are the result of broader factors such as industrialization, globalization, the information technology revolution, trends in artificial intelligence, and more. For investors with financial plans spanning years and decades, focusing on these longer-run trends is far more important than reacting to daily headlines.

The bottom line? Regardless of political views, investors should stay invested and diversified as the election season comes to a close. Clarity around taxes, tariffs, and other policies will help, but maintaining perspective around long-term trends is still the best way to achieve financial goals.

Perspective on the Fed and Market Sell-Off

To paraphrase Ernest Hemingway, shifts in the stock market often occur “gradually, then suddenly.” Over the past month, the market has rotated from large cap technology stocks to small caps and other sectors. Following the latest jobs report, however, global stocks experienced a sharp pullback due to concerns over the timing of Fed rate cuts, a weakening labor market, and disappointing tech earnings. Financial markets are on edge as investors adjust to a changing economic landscape.

Specifically, the Nasdaq is now in correction territory, defined as a 10% decline from recent highs. The S&P 500 has pulled back 5.7% from its high three weeks earlier, while the Dow has been steadier with a decline of 3.5%. The VIX, often described as the market’s “fear gauge,” has surged to its highest level since early 2023. The 10-year Treasury yield has now fallen below 3.8%, a sharp decline from 4.7% only three months ago.

Ironically, current macroeconomic conditions – inflation returning to 2%, low but rising unemployment, falling interest rates, and double-digit stock market gains – are exactly what investors had hoped for at the start of the year. Now more than ever, investors need perspective to navigate markets and stay on track to achieve their financial goals. How should investors view recent stock market swings as they position for the coming months?

Investors need perspective in volatile markets

Investors focused on recent performance alone would no doubt wonder if the cycle is over. While recent market events are still playing out, it’s important to remember that not only are stock market swings normal, but they can also be healthy if they are the result of investors adjusting to new economic facts. This is especially true if valuations improve as prices adjust and corporate earnings continue to grow.

For many investors, the volatility since 2020 may already seem like a distant memory after the steady recovery of the past year and a half. As the accompanying chart shows, the S&P 500 has gained 113% over the past five years, including the pandemic collapse and the 2022 bear market. While market pullbacks are never pleasant, viewing the market on these timescales does help to put the current decline in perspective.

It's no secret that technology-related stocks, particularly those related to artificial intelligence, have contributed greatly to these market returns. The Magnificent Seven, a group of stocks including Nvidia that benefits from recent trends, is still up a whopping 162% since the beginning of 2023, and has gained 362% since early 2020.

The rotation and now pullback in these stocks is the result of investor concerns over the magnitude of the rally and large tech company earnings. Whether AI and large language models can live up to their lofty promises has yet to be seen, and it’s not surprising that investors are growing antsy at seeing a return on the billions invested by large companies in these technologies.

So far, market fundamentals still appear to be strong regardless of how stocks move in the short run. Profit forecasts are still positive, with S&P 500 earnings expected to grow 13% over the next 12 months. More than half of S&P 500 sectors are expected to grow earnings by double digits, and all 11 sectors are forecasted to experience positive growth. In the long run, earnings are what drive stock market returns, and thus the health of the economy matters more than short-term stock and sector-specific trading activity.

Concerns are growing that the Fed has made a policy mistake

This is why concerns around the Fed have spooked the market in recent days. The Fed has now kept rates unchanged for over a year as it seeks “greater confidence” that inflation is returning to its 2% target. However, its focus on inflation is now resulting in a weakening labor market, which some fear could spiral toward a “hard landing.”

It’s important to remember how fickle market expectations have been. The year began with investors believing the Fed would need to cut rates several times due to an imminent recession. Expectations then shifted after a few hotter-than-expected inflation reports, with investors believing the Fed would not cut at all this year. Today, markets expect the Fed to cut in September and possibly at each subsequent meeting. These swings show how difficult it is to get monetary policy right, even as backseat drivers.

These dynamics have shifted the Fed’s focus to the labor market, with the Fed acknowledging that it is “attentive to the risks to both sides of its dual mandate.” The latest jobs report showed that the economy added 114,000 new jobs in July, lower than the consensus estimate of 175,000. Unemployment, which was expected to remain at 4.1%, rose to 4.3%. While this is still relatively low compared to history, it is the highest rate of unemployment we’ve seen since the pandemic (and mid-2017 before that).

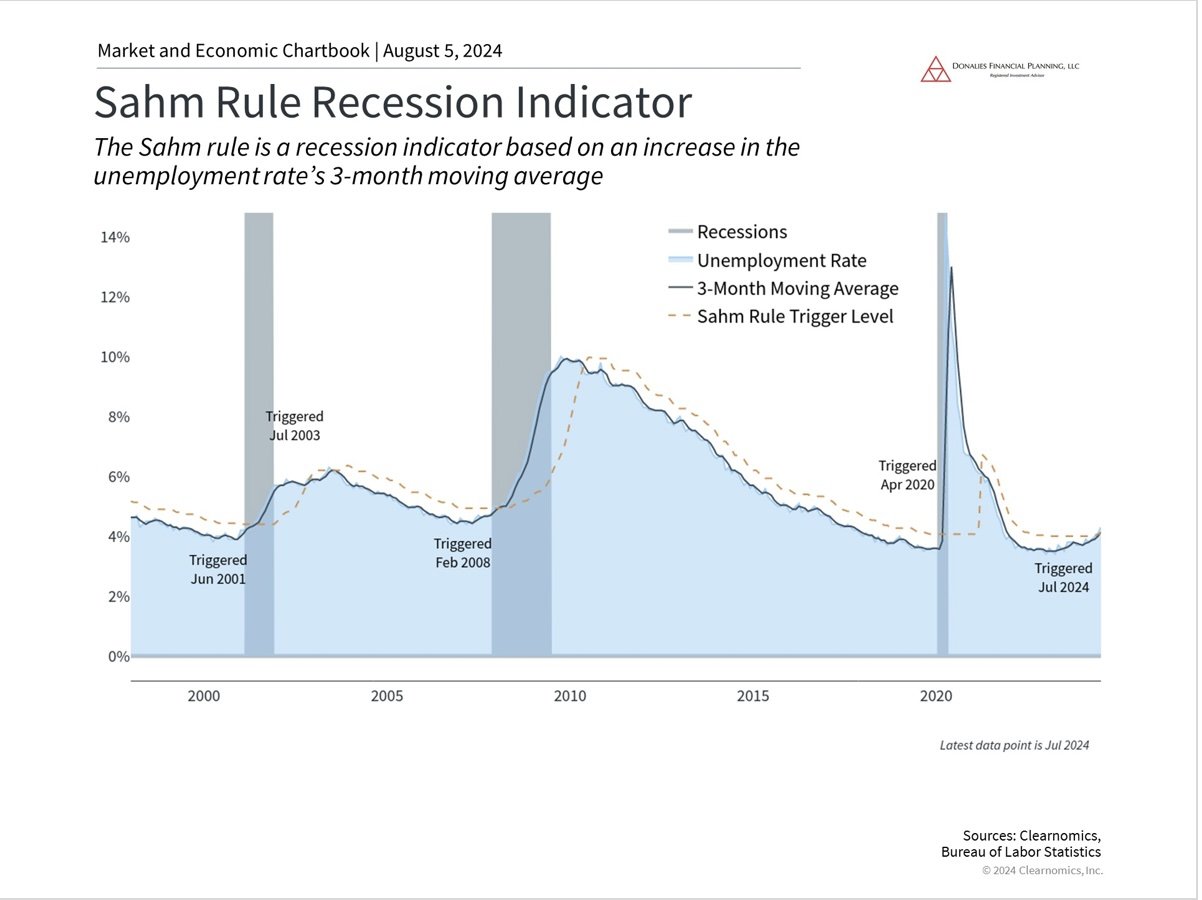

One reason economists are concerned about this increase in unemployment is an economic indicator known as the Sahm rule, shown in the accompanying chart. The Sahm rule, named after a former Fed economist, predicts the onset of recessions based on the trend in unemployment. The simple intuition is that a sudden jump in the unemployment rate is highly correlated with economic downturns. In fact, the very definition of a recession depends on the state of the job market.

The jobs report for July has officially triggered the Sahm rule, suggesting that the current unemployment rate is consistent with the historical pattern of recessions. However, it’s important to keep in mind that immigration and higher labor force participation, both positive factors, were key drivers in rising unemployment. Additionally, Sahm herself has stated that this is more of a “historical regularity” and not a hard-and-fast physical law. In other words, with unemployment still near historic lows, a rise in unemployment to 4.3% should be watched carefully but does not necessarily mean a recession is imminent.

Regardless, both sides of the Fed’s mandate – maximum employment and stable prices – now point strongly to a September rate cut. Investors are now worried that the Fed has waited too long to cut rates.

Whether this is the case has yet to be seen. There have been several historical instances that could be called “soft landings.” Perhaps the most notable occurred from 1994 to 1995 under Fed chair Alan Greenspan when the Fed doubled the federal funds rate from 3% to 6%. Inflation remained under control and the economy continued to grow, avoiding a recession.

Despite the positive outcome, this was a harrowing time for investors since it resulted in the worst bear market for bonds up to that point. However, it’s clear that the outcome was positive in the long run, since it set up the conditions for stocks and bonds to continue their long bull runs.

Historical hard landings, on the other hand, have often been the result of policy missteps rather than just sub-optimal timing. The Great Depression, for instance, was worsened by the Fed’s decision to tighten monetary policy at a time when expansion was needed. Similarly, the high inflation of the 1970s can be attributed to the Fed's overly accommodative stance when prices were rising rapidly. In both instances, the Fed’s actions were essentially the opposite of what economic conditions required, underscoring how severe policy mistakes can be.

Where does the Fed stand today? Very few argue that the Fed has made the wrong moves per se – just that they have not timed them well. While many may wish the Fed had cut rates at its last meeting, it is likely they will do so soon.

Investing is about both returns and managing risk

Investing is never a sure thing. In the classic book “A Random Walk Down Wall Street,” author Burton Malkiel writes that “the stock market is like a gambling casino where the odds are rigged in favor of the players.” Investing in the stock market comes with many risks that can be managed with proper portfolio construction and a long time horizon. History shows that despite the ups and downs of the market, staying invested is still the best way to grow wealth and achieve financial goals over the course of decades.

Stocks never move up in a straight line, so how we react to market volatility is perhaps more important than the volatility itself. The S&P 500 has now experienced its second 5% or worse pullback this year. As the accompanying chart shows, this is below the average of 4 to 5 pullbacks experienced in the average year, and the dozens during bear markets.

Additionally, current market concerns driven by tech stocks, the Fed, and the labor market all have their silver linings. The economy is still quite healthy, corporate earnings are still growing, and if interest rates do sustainably fall, many other parts of the market could benefit. As in past episodes of volatility, seeing past the current market moves and headlines is needed to benefit from the long-term trend.

The bottom line? Recent economic data have sparked concerns that the Fed should have cut rates sooner. Tech stocks have also declined as investors worry about valuations and earnings. In volatile markets, it’s important for investors to stay level-headed as they work toward their long-term goals.

First Quarter 2023 In Review

Summary

2022 ended and one could almost hear investors breathe a sigh of relief. 2023 got off to a good start, with financial markets rebounding from the lows in 2022. Megacap companies, such as Alphabet, Apple, Meta, and Microsoft led the way in the recovery as they reported mostly strong earnings, layoffs (reducing expenses), and, in the case of Alphabet and Microsoft, new artificial intelligence (AI) tools, such as ChatGPT (it's an interesting tool, one I've enjoyed playing with, but I don't think we have to bow before our new AI overlords...yet).

Things were humming along nicely until the threat of a new banking crisis formed as Silicon Valley Bank (SVB) failed due to a run on the bank. Think "It's a Wonderful Life" but with many more venture capitalists. That, of course, is an overly simplified version of what actually happened at SVB. Many individuals and businesses were impacted negatively by the bank run. Fortunately, the federal government stepped in to guarantee all deposits at SVB and Signature Bank, another bank that collapsed, before the contagion could spread.

While the banking crisis took over the news, the debt ceiling fight in Congress got pushed to the back burner. Expect to hear a lot more about this issue in the coming weeks. Let's hope our elected officials come to their senses before they harm the economy and financial markets.

The Federal Reserve continued raising interest rates throughout the first quarter as inflation continued to cool. Based on the most recent statement from the Fed, it appears they be nearing the end of this cycle of rate hikes.

Ultimately, it was a good quarter for global markets across the board.

First Quarter 2023 Numbers

If you recall, the average diversified U.S. stock fund, which is a better measure of how we invest than the S&P 500 or the Dow, was down over 18% for all of 2022. Finally some good news for investors: The average U.S. stock fund rose nearly 6% during the first quarter. Despite the gain, investors remained cautious about domestic stocks, pulling over $68 billion from funds in that category during the quarter.

International stocks, down 17% in 2022, also rose during the first quarter, with the average diversified international stock fund up a little over 8%, besting U.S. stocks. International stock funds saw inflows, over $10 billion, during the quarter.

Investors, concerned about U.S. stocks, invested nearly $67 billion into of bond funds during the first quarter. The average intermediate-term bond fund, down over 13% in 2022, gained about 3.0% during the first quarter.

Returns By Broad Category

Can't read this? Here's a link to a PDF of this chart.

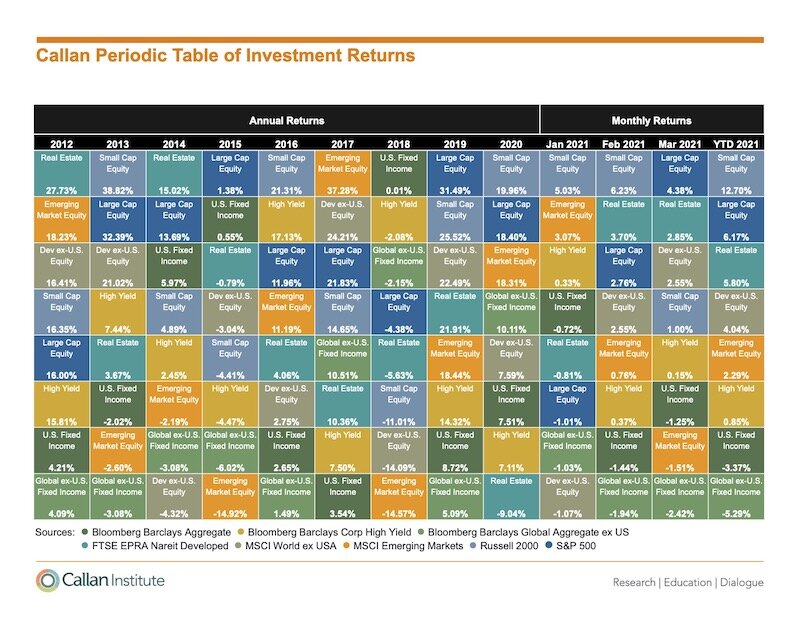

The chart above provides a high-level view of how the broad asset categories have fared annually from 2008 - 2022 and the first quarter of 2023 (the column labeled "YTD"). The category titled "Asset Alloc." refers to a 60% stock/40% bond portfolio (often referred to as the 60/40 portfolio).

Year-to-date, the three top-performing categories are:

International developed markets ("DM Equity",+8.6%).

Large cap U.S. stocks (+7.5%).

International emerging markets ("EM Equity", +4.0%).

Note how the average 60/40 portfolio's returns are squeezed in between Large Cap and EM Equity. The 60/40 portfolio isn't dead (it never was).

I love this chart and always look forward to seeing the updated version. Two takeaways:

Notice any patterns? If you answered "yes", we need to talk because your brain operates on a different level than mine. It's impossible to consistently predict which categories will perform best from year-to-year or month-to-month.

This chart is Exhibit A for why it's prudent to build diversified portfolios. Sadly, diversification means you're always having to say you're sorry because it's rare for every category to produce positive returns.

Update: Series I Bonds

Last year, from May 1, 2022 through October 31, 2022, Series I Bonds rates peaked at 9.62%. That was an amazing rate in year that was lousy for investors. Demand for bonds was so great that the TreasuryDirect website crashed.

The rate declined to 6.89% from November 1, 2022 through April 30, 2023. While not as good as 9.62%, 6.89% was still pretty good.

As the saying goes, all good things must come to an end: The new rate from May 1, 2023 through October 31, 2023 is 4.30%. Okay, this rate isn't that bad because Series I Bonds are extremely low-risk investments. The downside is the opportunity cost of investing in stocks, which had a higher return during the first quarter.

Does it make sense to invest additional money in I Bonds? If you bought I Bonds last year, should you continue to hold your I Bonds, or is it better to redeem your bonds and invest elsewhere?

Like many things in finance the answer is "it depends".

In general, Series I Bonds might be a good investment for you if:

Your risk tolerance is relatively low. Perhaps you're a cautious investor who can't sleep at night when the market is volatile. Or maybe you're a retiree who needs to focus more on asset preservation rather than growth.

You have surplus cash to invest. Let's say you've set aside enough cash to cover at least 3-6 months (or more!) of living expenses AND you are maxing out your retirement savings AND you are investing regularly in a taxable brokerage account. If you're doing all of those things and you still have cash left over than Series I Bonds might be a good, ow-risk investment.

You don't need the cash for a 12 months, or longer. This one is important. The minimum holding period for Series I Bonds is 12 months. If you think you might need access to the cash earlier than 12 months, you should invest elsewhere.

It's impossible to capture everyone's unique situation using the three rules above. I'm happy to help you determine if Series I Bonds are right for you. Contact me if you want to chat.

Perspective

Given the recent declines in the financial markets, I think it's a good time for a reminder: In the short run, investments don't always go up.

No one likes seeing losses in their portfolio, but it's unavoidable. Fortunately, we can zoom out and the long-term picture is an upward trend.

To demonstrate this, I built a basic portfolio, 80% stocks and 20% bonds, using three investments:

60% Vanguard Total Stock Market Index ETF (VTI)

20% Vanguard Total International Stock Market Index ETF (VXUS)

20% Vanguard Total Bond Market Index ETF (BND)

Below, you'll find two charts. The first chart shows performance of the 80/20 portfolio from January 1st, 2022 through May 6, 2022. The second chart shows performance of the 80/20 portfolio from May 7, 1997 through May 6, 2022 (25 years!) and includes five events that had a negative impact on the financial markets.

For investors, living through those events was painful. However, the markets bounced back, creating the positive upward trend that's clearly visible.

Year-to-date return of a portfolio invested in 80% stocks and 20% bonds.

25-year return of a portfolio invested in 80% stocks and 20% bonds.

What Should Investors Do?

In my opinion, here are the best things you can do when dealing with declines in the financial markets:

Do nothing. Stay invested and stick to your financial plan.

Continue to invest. Everyone likes buying things when they're on sale. Here's your opportunity!

Stop checking the balance of your portfolio. Remember, the long-term trend is upward, but the day-to-day, week-to-week, and month-to-month performance of your investments will be all over the place.

Turn off the financial "news". Financial media, such as CNBC, loves when markets are volatile. Please ignore their "experts".

Consider tax-loss harvesting. This is a somewhat advanced strategy that involves selling a taxable investment at a loss to offset realized capital gains or up to $3,000/year of earned income. Talk to your financial planner about this option.

First Quarter 2022 In Review

Summary

Investors endured a lot over the last three years: A global pandemic (which is still hanging around), supply chain problems (also still here), rising inflation (probably still rising), and Elon Musk's shenanigans (no sign of stopping). Despite all of those things, global financial markets were surprisingly resilient, delivering three straight years of big gains. In case you need a refresher, the S&P 500 Index, a reasonable proxy for "The Market", had the following returns over the past three years:

2019: 31.49%

2020: 18.40%

2021: 28.71%

2022 got off to a decent start. People were vaccinated, shutdowns were easing, and people were starting to travel again. Sure, the problems listed above were still with us, and the Fed was threatening to raise interest rates in order to combat inflation, but things were looking up. Unfortunately, I don't think many people had "Russia invades Ukraine" on their bingo cards.

If there's one thing investors hate, it's uncertainty. And the invasion injected plenty of uncertainty into people's everyday lives as supply chains were strained further, global payment systems were disrupted, and energy prices skyrocketed. Tack on rate hikes from the Fed and the result was a decline in stocks and bonds during the first quarter, with the Dow Jones Industrial Average down 4.6% and the S&P 500 down 4.9%.

No one likes seeing their investments decrease in value. But it happens. I believe this time might feel worse because we've had such an incredible run over the past three years. Hang in there. Everything will be fine.

First Quarter 2022 Numbers

The average diversified U.S. stock fund, which is a better measure of how we invest than the S&P 500 or the Dow, fell just over 6% during the first quarter.

International stocks also declined, with the average diversified international stock fund down a little over 8% during the first quarter.

Despite the declines in both domestic and international stocks, investors plowed money into both categories, about $70 billion and $31 billion, respectively.

Investors, perhaps realizing bonds weren't a safe haven, pulled nearly $89 billion out of bond funds during the first quarter. The average intermediate-term bond fund lost almost 6.0% during the first quarter.

Returns By Broad Category

Can't read this? Here's a link to a PDF of this chart.

The chart above provides a high-level view of how the broad asset categories have fared annually from 2007 - 2021 and the first quarter of 2022 (the column labeled "YTD"). The category titled "Asset Alloc." refers to a 60% stock/40% bond portfolio.

I love this chart and always look forward to seeing the updated version. Two takeaways:

Notice any patterns? If you answered "yes", we need to talk because your brain operates on a different level than mine. It's impossible to consistently predict which categories will perform best from year-to-year or month-to-month.

This chart is Exhibit A for why it's prudent to build diversified portfolios. Sadly, diversification means you're always having to say you're sorry because it's rare for every category to produce positive returns.

Series I Bonds

Over the past few weeks I've received many inquires about Series I Bonds. Why? Because the current interest rate, through April, is 7.12%. That's a fairly amazing rate for what is nearly a risk-free investment.

Should you buy I Bonds? Like many things in finance the answer is "it depends".

I Bonds might be a good investment for you if:

You have set aside enough cash to cover at least 3-6 months (or more!) of living expenses.

You can afford to hold the I Bonds for 12 months, which is the minimum holding period.

Three more things:

The maximum amount you can purchase is $10,000/year per person. That means a couple can purchase up to $20,000/year.

The actual details about how much you can purchase are a bit complicated. I don't want to confuse the situation by adding those details here, so please do not send me an email that starts off with something like "Well, actually...." because I'll roll my eyes and get angry. And you wouldn't like me when I'm angry.

I'm happy to help you determine if I Bonds are right for you. Contact me if you want to chat.

Mr. Market's Wild Ride

People in the crypto space like to use the acronym "FUD" (fear, uncertainty, and doubt) when referring to negative happenings in investments or financial markets. It's safe to say FUD has crept into most markets. Caused by a reaction to central bank inflation, high debt levels, weak economic growth, geopolitical tensions, incompetent political parties, and continual bureaucratic intervention.

Nine days before Black Monday (the initial October 28, 1929 crash) Yale economist Irving Fisher said “Stock prices have reached what looks like a permanently high plateau.” It’s one of the worst market readings ever. Of course, our markets had a very rough decade. Nobody knows what that market is going to do over three days or three years… but we have a pretty good idea of what will happen over three decades. Time IN the market is wise, timing the market is human but foolish. While invested, we should be prepared for anything.

Major market movements present opportunities to reconnect with the basic principles of investing, such as having (and sticking with!) an investing strategy, diversifying one's investments, letting the magic of compounding work for you, and keeping investment expenses low. These principles are important because nobody knows what is going to happen next. Legendary investor, and perma-bear, Jeremy Grantham thinks we may have a Wild Rumpus, but he's been calling for the bubble to burst since 2016. Maybe he's correct this time. Again, nobody knows what is going to happen next, so the best course of action is to stay calm and stick to one's plan.

Here are the questions and topics I encourage investors to think through on a regular basis - not just when there's FUD in the financial markets:

Goals

What is this specific money for?

(What Values, Intentions, Purposes, or Goals does it support?)Have your goals changed?

(We should always match our investments to specific goals.)What is the timeline? (Your investment and goal should always be connected to a timeline.)

Risk

Is your real Risk Preference at the moment a lot lower than your Risk Tolerance when thinking about a possibility? Is it a lot scarier now that it is happening? There is the risk your wallet can mathematically handle (Risk Capacity), the risk your head thinks it can handle, and the risk your stomach can actually handle. You have to find the optimum point in that triangle for you and your spouse, and it is usually at the lower end.

Portfolio & Planning

Is it time to rebalance your portfolio? (You can also rebalance by adding.)

Is it a good time to invest a little more?

Does this show you that you need some liquidity?

Are you SURE you want to sell into weakness and realize what is right now probably a temporary paper loss?

Asset Class Diversification helps protect against many other returns you don’t see like the sequence of return risk. (Yes, you need bonds, cash, and other non “growth” assets. Retirees need even more fixed income. You draw from the well that is currently full.)

If you have a lot of individual investments you should be looking at tax-loss harvesting, your investment manager should have already done it.

Crypto markets are highly volatile, that is why they can return so much. High risk, high reward- but high risk. This is probably the first true crypto winter, and that’s okay. There is a real utility and infrastructure built into the system, the exchange rails are operating properly, and communities are going about their business. The value of the token dropping because of irrational fear, or the value skyjacking because of irrational exuberance does not change the underlying utility and value. Flippers and bubbles cause disruption, but they don't stop the real work from being done underneath. (Here's a good short article on viewing crypto risk in relation to other assets.)

Market timing is usually a fool’s errand. Here's a good (fictional) example.

Stick To Your Plan

If you're a client, you already have a financial plan in place and you know you can always contact me to discuss the things mentioned above.

Not a client? Feel free to schedule an initial consultation if you want to talk about creating a financial plan.

The Fiduciary's Dilemma: How Should Financial Planners Talk To Clients About Crypto?

The Dark Tower

During the pandemic I reread The Dark Tower, Stephen King's eight-book series which blends the genres of fantasy, horror, science fiction, and Western. It's an impressive piece of work that I revisit every few years in either book or audiobook format.

The story follows Roland Deschain, the last gunslinger of Mid-World, as he searches for the Dark Tower. The epic tale includes multiple trips to our world and several parallel worlds. Somewhere around book three Roland begins to question his sanity because his mind holds true two different versions of events that happened in parallel worlds. The decisions he must make in the future depend heavily on which version of events are correct.

To be clear, I am not a gunslinger. Nor am I questioning my sanity. However, I am conflicted about about two truths:

Crypto is extremely risky and could end to significant losses.

Crypto, specifically the underlying blockchain technology, could revolutionize the financial system and, like the early days of the internet, it presents an incredible opportunity for investors.

How does a financial planner, one who cares about his clients and recommends well-diversified portfolios comprised mostly of index funds and the occasional individual stock, talk to clients about cryptocurrencies?

I'm Not Alone

Ask 10 different financial planners which investments to use in a portfolio and you'll receive 10 different answers, with some general overlap of ideas. The same is true of crypto. When it comes to this subject, the financial planning forums I frequent have had some lively discussions, with the most common responses being:

This is no different than the tulip mania of the 1600s!

There's something to the underlying technology, but this is way too risky for my clients!

My clients have been buying crypto on their own, but I won't provide advice about it!

It's probably time to begin talking about crypto with my clients!

My impression is that the subject of crypto is similar to the Dotcom tech bubble of the late '90s. I was in college during that time, so I don't know what financial planners were telling their clients. Obviously, some bought into the craze while others avoided tech stocks altogether.

For example, I recently listened to an interview with legendary investor Jeremy Grantham. He refused to buy tech stocks during that period and ended up losing 50% of his clients. Fortunately, his firm rebounded nicely in the aftermath of the bubble. In the end, he made the right call but I'm sure it was difficult for him to tell clients "no" while watching his business crumble.

Regardless of what advisors think about crypto, or whether or not cryptocurrencies are "investments", many of our clients are curious and some have already purchased crypto.

Digital Assets, Not Currencies

I'm intellectually curious about many subjects, including crypto, which I've taken to calling digital assets. Why digital assets instead of cryptocurrencies? While these assets can be used to pay for things, I cannot understand why anyone would pay for a good or service using a "currency" that has a history of fluctuating 20% or more in a short period of time, sometimes within 24 hours.

Over the past year I've done a lot of reading about digital assets; how they work, potential use cases, etc. During that time, I've come to believe the truth, like many things, is somewhere in the middle.

Some digital assets are definitely a scam (I'm looking at you, dog-themed tokens). Amazon survived and flourished after the Dotcom crash and I believe some digital assets will, too. I just don't know which ones.

Some industries will be revolutionized by the underlying technologies (banking, trading, and gaming require fast, secure transactions, which could be powered by blockchain technology). Unfortunately, the timing and scope of these changes are impossible to predict right now.

So What's the Best Approach?

I believe planners owe it their clients to have an open discussion about the considerable risks and potential upsides of digital assets. Here's a list of some of the most pressing issues:

Regulatory. When it comes to money, most governments have a vested interest in maintaining the status quo. This is especially true in the United States, where the dollar is used as a global reserve currency. Digital assets may not be banned, but they could be regulated to the point where their use is significantly diminished.

Obsolescence. If you think of digital assets as software or programmable money, it's possible that even better, more sophisticated forms could be created, quickly replacing older, obsolete digital assets.

Volatility. As I mentioned earlier, I cannot understand why anyone would spend an asset that could fluctuate wildly in value over short period of time.

Cyber risk. Buying digital assets via a mobile app isn't difficult, but there have been many cases of exchanges being hacked. I suspect exchanges will be targeted again, especially as investors and institutions pour money into this category.

Password and/or seed phrase management. Owners of digital assets can transfer their assets to a hardware wallet, also known as cold storage. Doing so can secure the asset but requires some technical expertise. More importantly, it requires proper management of passwords and seed phrases. I know many people who can barely remember the passwords to their Netflix accounts, let alone a wallet containing a potentially significant portion of their savings.

24/7 trading. Unlike traditional financial markets, trading in digital assets takes place 24/7. I'm not sure everyone will be willing to monitor their portfolio on evenings and weekends.

Takeaways

Are digital assets any different from the tulip mania of the 17th century or the Dotcom boom of the '90s? I don't know, but this surge may feel different from the others because we're living through a period of upheaval: the COVID-19 pandemic disrupted the world's systems, supply chains are broken, people are rethinking how and where they want to be employed, and the internet and social media have changed the ways in which we communicate and trade.

Digital assets have the potential to revolutionize industries and provide incredible opportunities and returns for investors. However, the risks are considerable and anyone buying or holding digital assets should familiarize themselves with the risks. The asset should fit within your financial plan and your risk tolerance. More importantly, you should never invest more than you can afford to lose.

As always, I'm happy to answer questions about this topic or any other.

Downtime

Here are some things that have my attention when I'm not working:

Listening:

Podcast: I started listening to a new podcast, How We Survive, which examines what's needed for the transition away from fossil fuels. The first episode is great if you've ever wondered where we're going to get enough lithium for all the batteries in our fancy electric cars and other devices.

Watching:

Dune. This week, the only entertainment that matters to me is Dune on HBO Max. I have high hopes for this adaptation of the sci-fi classic.

First Quarter 2021 In Review

Summary

For investors, 2021 is off to a good start. That doesn't mean the first three months of the year have been smooth sailing. Despite hitting all-time highs, financial markets saw some big swings during the first quarter. The volatility might have made you nervous. That's understandable. Keep in mind that big swings are normal. Stocks don't always go up.

The gains in the prices of stocks, housing, and cryptocurrencies have caused some investors, economists, and financial pundits to bring up the dreaded b-word, bubble, again and again. Is this a bubble? I don't know. No one knows. Anyone who tells you they know this is a bubble, and when it will burst, is lying.

Here's what we do know, with at least a reasonable degree of certainty:

The COVID vaccines continue to be produced, shipped, and processed throughout the U.S. and the world

Vaccinated people will be able to slowly resume normal activities

Employment will pick up

The economy will continue to recover

Unless your life situation or goals have changed, you should stick to your financial plan, which includes maintaining a properly diversified portfolio of investments

First Quarter 2021 Numbers

The average diversified U.S. stock fund, which is a better measure of how we invest than the S&P 500 or the Dow, gained about 8.5% during the first quarter of 2021. Small cap stocks continued to shine, outperforming all other investment categories during the quarter. Investors, optimistic about a recovery, pushed $78 billion into U.S. stock funds.

International stocks were also up for the quarter: The average diversified international stock fund rose about 3.5%. Investors demonstrated confidence in international stocks funds by investing a little over $27 billion in those funds during the quarter.

The average intermediate-term bond fund declined nearly 3.0% during the first quarter. Despite the decline, investors plowed nearly $2255 billion into bond funds over the three-month period.

Returns By Category

Need a magnifying glass to read this? No problem. Here's a link to a PDF of this chart.

The chart above provides a high-level view of how the asset categories performed for the years 2012 to 2020, January through March 2021, and year-to-date 2021.

I love this chart and always look forward to seeing the updated version. Two takeaways:

Notice any patterns? If you answered "yes", we need to talk because your brain operates on a different level than mine. It's nearly impossible to consistently predict which categories will perform best from year-to-year or month-to-month.

This chart is Exhibit A for why it's prudent to build diversified portfolios. Sadly, diversification means you're always having to say you're sorry because it's rare for every category to produce positive returns.

Market Volatility and Investing

Need a magnifying glass to read this? No problem. Here's a link to a PDF of this chart.

In the Summary I noted the financial markets were volatile during the first quarter of 2021. In order to reinforce my comments about (a) ignoring short-term volatility and (b) maintaining a well-diversified portfolio, I'm sharing a chart from BlackRock.

The chart shows 1-year returns of stocks from 1930 - 2020. The obvious takeaway is that there are far more years with positive returns than negative. Less obvious, but perhaps more important to keep in mind, is that for any given year the markets probably had wild swings from day-to-day. Hang on and stick to your plan.

Finally, a client asked me to include a reference to WandaVision in my next post. So.....

3 Takeaways From the GameStop Debacle

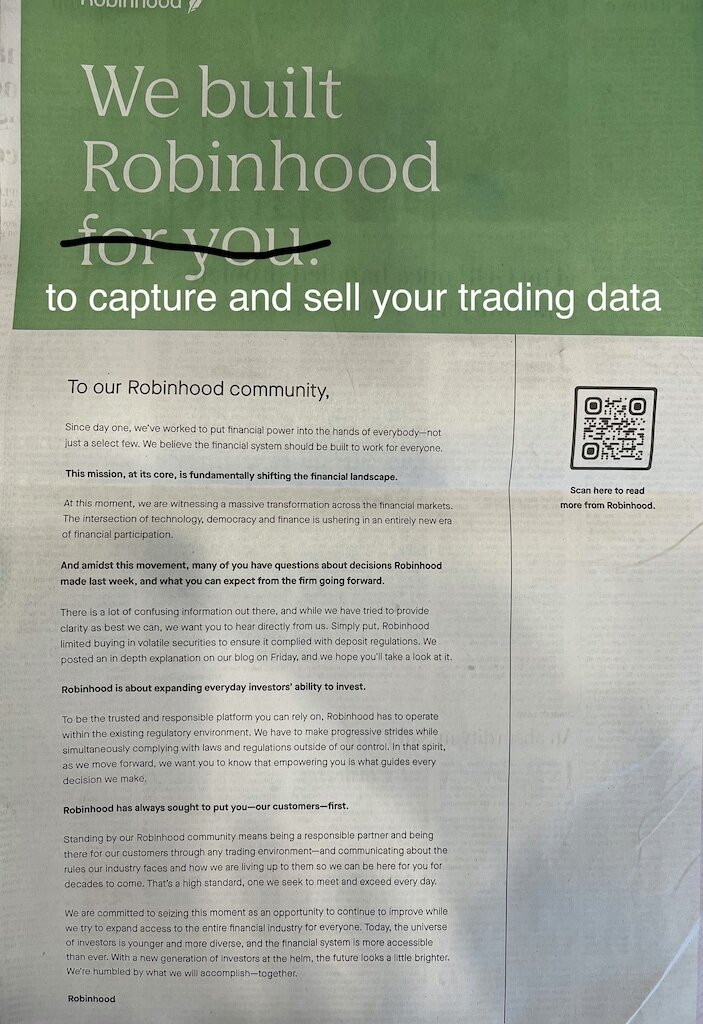

This full-page ad for Robinhood was featured in the Tuesday edition of The Washington Post. It was also misleading, so I fixed it.

If you've been paying attention to the news over the last week, you've probably noticed GameStop has been in the news a lot. The company, which sells physical video games, consoles, and accessories, was involved in something called a short squeeze. The story behind the debacle is more complicated than it appears and involves a large cast of characters, including hedge fund managers, professional traders at large institutional investment companies, securities regulators, regular Jane/Joe retail investors, and an army of angry, overzealous investors who organized on the WallStreetBets subreddit.

I'm not going to use this space to explain what happened and why; there are excellent summaries available to read online or, if you prefer audio, to listen to in podcast format. If you're interested, here are two good resources (the podcast provides an great timeline of what happened):

"The Whole Messy, Ridiculous GameStop Saga in One Sentence" by Derek Thompson of The Atlantic.

E19 of All-In with Chamath, Jason, Sacks & Friedberg: "Breaking Down Robinhood's GameStop Decision: Why did it happen and how can it be prevented in the future?". 1 hour, 26 minutes.

Again, I'm not going to summarize what happened. Instead, I want to highlight the three most important takeaways for investors.

#1: Wall Street Finds A Way

There's a scene in Jurassic Park where Dr. Ian Malcom (Jeff Goldblum) delivers the line "life finds a way". In the context of the movie the quote means that no matter what happens in life, species and nature will always find a way to reproduce and survive - even in nature's harshest conditions.

Wall Street operates in a similar manner. There are rules and regulations in place to ensure our free market system (which maybe isn't so free, but I'll get to that in takeaway #2) runs smoothly. For the most part, buying and selling of securities occurs on weekdays without too many hiccups. However, under extreme conditions, the rules can be changed in order to ensure the system continues to survive. For example, Robinhood made the surprising decision to restrict trading of shares in companies like GameStop, AMC, BlackBerry, and Nokia as shares of those companies hit new highs*.

For additional examples of Wall Street changing the rules mid-game, I recommend the book Business Adventures: Twelve Classic Tales from the World of Wall Street by John Brooks.

The takeaway: Wall Street will always do what is necessary in order for the system to survive. Unfortunately, some investors may be negatively impacted when the rules are changed.

*Without getting too wonky, I believe Robinhood was forced to restrict trading of certain companies because it was undercapitalized.

#2: Zero-Commission Doesn't Mean Free

Robinhood was one of the first companies to offer zero-commission trades for stocks and ETFs. The move placed pressure on the large brokerage companies, so E*Trade, Fidelity, Schwab, and TD Ameritrade quickly followed suit.

Overall, I believe the elimination of trading fees was positive for investors. Trading fees, often a barrier to entry, have been falling for decades. Their elimination, combined with gamified trading apps like Robinhood, opened up investing to millions of people - especially younger investors.

But, as we've seen over the past week, there are downsides to zero-commission trades.

First, there's the behavioral aspect. Unburdened by trading fees, investors have been incentivized to trade more frequently. Millions of day traders, professional and amateur alike, can now buy and sell stocks and ETFs throughout the day.

Second, and most relevant in this case, is that zero-commission doesn't always mean free...and Robinhood is the poster child for "free" trading. That's because Robinhood generates revenue from high-frequency trading and payments for order flow, a practice whereby a broker receives compensation for directing orders to different parties for trade execution. For example, Robinhood earns significant revenue by directing trades and data to firms such as Citadel Securities*, who in turn use that data to front-run Robinhood's investors. This isn't illegal, but I believe it's a conflict of interest.

The takeaway: When it comes to trading, "free" doesn't always mean free. Investors should try to understand what service providers do with user data as well as how the company makes money.

*Citadel Securities was one of two firms that provided $2.75 billion to Melvin Capital, a hedge fund that was shorting GameStop and losing billions while the share price skyrocketed. An injection of cash like this is known as backstopping.

#3: Ignore FOMO

If you spend any time in r/WallStreetBets on Reddit, you'll find posts and screenshots from users bragging about their earnings from trades in companies like GameStop. Seeing other people earn money, sometimes big money, off of trading can inspire jealousy or fear of missing out (FOMO). Once the trading frenzy subsides, and you never know when that might be, someone is going to be left holding the bag, and that someone might just be you.

The takeaway: When you hear about others' investing successes, try to ignore FOMO. While some people made big money gambling on GameStop, the majority did not.

In Conclusion

To wrap up this post I'm going to drag out another pop culture reference: The Terminator. This time I'm going to paraphrase Kyle Reese:

"Wall Street can't be bargained with. It can't be reasoned with. It doesn't feel pity, or remorse, or fear. And it absolutely will not stop, ever, until you are dead."

Be careful when investing. If you don't know what you're doing I recommend educating yourself or, better yet, avoiding hot stocks that are probably too good to be true.

Or, to once again paraphrase Kyle Reese, "Come with me if you want to be a better investor".

Ongoing Volatility in the Financial Markets

There's no way to spin this: Monday was a rough day for investors.

The Dow was down 7.8%

The S&P 500 fell 7.6%

The Nasdaq Composite slid 7.3%

Reminder: Take a deep breath. And another. It's all going to be okay.

Health Crisis: Downturn to Recovery

Historically, downturns caused by health crises don't last forever. The charts above show the SARS and Zika crises from 2003 and 2016, respectively. In both cases, the sell-off trough lasted for much of the first quarter before stocks resumed their upward trend.

I can't tell you when things will turn or by how much, but my expectation is that investors bearing today's risk will be compensated with positive expected returns. Unfortunately, history has shown no reliable way to identify a market peak or bottom. This means it is unwise to make market moves based on fear or speculation, events difficult and traumatic events transpire.

In other words, stick to your financial plan.

It's Okay to Be Nervous

Note: My friend and fellow financial planner Will Kaplan, CFP® wrote the following three paragraphs. I couldn't improve upon them, so I asked him if I could include them here. Enjoy.

Feeling nervous as the market drops is normal. That is part of our biological response to bad news. As humans we feel bad news about twice as intensely as we experience good news. It's just how we are wired and part of why being investors is so challenging.

Courage does not mean that you are not afraid. Courage is doing something even though it is scary. It is okay to be afraid, but fear should not be our only guide.

Discipline is remembering that we know markets go down from time to time and remembering that we have a plan for when they do. We rebalance the portfolio (when necessary) to maintain the asset allocation. We want to be buying when markets are down and selling when markets are up. The challenge isn't in knowing what to do, but in being disciplined and not allowing our emotional response to derail our plan.

One Last Thought

The late Jack Bogle, founder of Vanguard, once commented in other periods of heightened volatility in the markets, "The expression is 'don't just stand there, do something' and the best rule I think is 'don't do something, just stand there.'"

While the news in the short-term may get worse before it gets better, long-term perspective and patience are necessary to ride out short-term volatility in the markets. Hang in there.

Knowing When To Let Go

Sticking With It...Or Not

A couple of weeks ago, a friend asked if I had watched the most recent season of House of Cards. I responded that I had stopped watching partway through the 5th season because I was no longer enjoying it. My friend and his wife were slogging through the final season, determined to finish it even though they too weren't enjoying it.

Over the past few years, I have become much less likely to continue reading or listening to books, watching TV shows or movies, or playing video games that I wasn't enjoying. Homo Deus: A Brief History of Tomorrow by Yuval Noah Harari? Set it aside after it kept putting me to sleep. The Walking Dead? Stopped watching after season seven shambled on what seemed like forever. Far Cry 5? Deleted from my PlayStation 4 after growing tired of boring fetch quests.

As I've gotten older I've become more conscious, and more protective of, my free time. Call it the Marie Kondo Effect: Why waste precious time on something that doesn't bring me joy?

We all love instant gratification, but not everything has to bring you instant or constant joy. Sometimes challenging things are worth it. The Count of Monte Cristo is one of my all-time favorite books, but parts of it drag. Still totally worth it.

Buying...Or Selling

I know this will shock you, but I often relate things to investing. The decision about whether or not to stick with something that no longer brings us joy is similar to what happens when we invest. Sometimes we hold on for too long; sometimes not long enough.

Hopefully, the decision to buy or sell an investment isn't based on emotion, such as joy. Instead, the decision should be made based on logic and quantitative measures, such as price, expenses, and the need for diversification.

Sadly, as I've written previously, investing is hard. Humans are emotional creatures and we're often lousy at making rational decisions. We buy high and sell low. We take on more risk than we need to.

My advice: Try to reserve your emotional decisions when choosing things like books, TV shows, movies, and video games. And, if you've given something a fair chance and you aren't enjoying it, don't be afraid to let it go. Unless it's The Count of Monte Cristo. You need to stick with that book.

When it comes to investing, check your emotions at the door.

Ten Years!

It's difficult to believe that ten years ago this month the S&P 500 finally hit the bottom. Check out the chart below to see how it has bounced back.

Reading / Watching / Playing

Here's what has my attention right now:

Bad Blood: Secrets and Lies in a Silicon Valley Startup by John Carreyrou. The rise and fall of Theranos and its CEO, Elizabeth Holmes, is a fascinating tale of corporate fraud, greed, and the insanity that is Silicon Valley. I'm about halfway through the book and it is fantastic. Highly recommended!

Marvel's Spider-Man on the PlayStation 4. The thrill of swinging through the man-made canyons of Manhattan never gets old. I'm no fan of spiders, but maybe getting bitten by one that's radioactive wouldn't be so bad. PS: There's a cameo by the late Stan Lee that is simply perfect.

Stay Calm And Focus On Your Plan

Volatility and Anxiety

As of today, December 7, 2018, the US market (as measured by the S&P 500 Index) has fallen about 6% over the last three months, resulting in many investors wondering what the future holds and if they should make changes to their portfolios. While the S&P 500 Index may still be in positive territory for the year-to-date, it may be difficult to remain calm during a substantial market decline, it is important to remember that volatility is a normal part of investing. Additionally, for long-term investors, reacting emotionally to volatile markets may be more detrimental to portfolio performance than the drawdown itself.

Reacting Impacts Performance

If one was to try and time the market in order to avoid the potential losses associated with periods of increased volatility, would this help or hinder long-term performance? If current market prices aggregate the information and expectations of market participants, stock mispricing cannot be systematically exploited through market timing.

Translation: It is unlikely that investors can successfully time the market, and if they do manage it, it may be a result of luck rather than skill.

Further complicating the prospect of market timing being additive to portfolio performance is the fact that a substantial proportion of the total return of stocks over long periods comes from just a handful of days. Since investors are unlikely to be able to identify in advance which days will have strong returns and which will not, the prudent course is likely to remain invested during periods of volatility rather than jump in and out of stocks. Otherwise, an investor runs the risk of being on the sidelines on days when returns happen to be strongly positive.

The following chart helps illustrate this point. It shows the annualized compound return of the S&P 500 Index going back to 1990 and illustrates the impact of missing out on just a few days of strong returns. The bars represent the hypothetical growth of $1,000 over the period and show what happened if you missed the best single day during the period and what happened if you missed a handful of the best single days. The data shows that being on the sidelines for only a few of the best single days in the market would have resulted in substantially lower returns than the total period had to offer.

The Takeaway

While market volatility can be nerve-racking for investors, reacting emotionally and changing long-term investment strategies in response to short-term declines could prove more harmful than helpful. By adhering to a well-thought-out investment plan, ideally agreed upon in advance of periods of volatility, investors may be better able to remain calm during periods of short-term uncertainty.

In other words, stay calm and stick to your plan.

Diversification: The Avengers of Investing

This week, the creator of Marvel Comics, Stan Lee, passed away. In case you aren't familiar with Lee's work, he created or co-created some of the world's most popular comic book characters: Iron Man, The Incredible Hulk, Thor, Spider-Man, Dr. Strange, and Black Panther are just some of his creations. In honor of Lee's work, it seemed appropriate to revisit a basic principle investing, diversification.

You're probably wondering what comic book characters have to do with investing. Consider The Avengers, a team of superheroes who work together to save the day (most of the time). Individually, they can't succeed because each of them has strengths and weaknesses. Put them together and they are nearly unstoppable. Will there be ups and downs? Yes, but in the end everyone is better off working together.

When you invest, the concept of diversification works the same way.

What is diversification?

The short answer is that diversification means not putting all of your eggs in one basket. Iron Man is great. Seriously, who wouldn't want Tony Stark's brains, money, and sweet armor? However, when the fate of the world is at stake, as it always is, the odds of saving the day are vastly improved when Iron Man is assisted by Captain America, Thor, Hulk, Black Widow, and Hawkeye. If Iron Man gets knocked down another member of the team can step up and get the job done.

So how does this relate to investing?

Let's use Apple as an example of how diversification works in the world of personal finance. Apple is a highly profitable tech company. However, owning a portfolio comprised only of Apple stock is not a good long-term strategy. Let's say Apple's stock falls 20% because consumers stop buying iPhones. You won't be a happy camper if Apple is your only investment!

The solution

You need to create your own team of superheroes! Unfortunately, the team you'll create won't feature a giant green rage monster or a Norse god wielding a magic hammer. Instead, your team will be comprised of companies in different categories, such as Wells Fargo (financial services), Exxon Mobile (oil & gas), Pfizer (pharmaceutical), and Proctor & Gamble (consumer products). Why companies in different categories? Because it's impossible to predict which categories will be best from year to year. The following chart shows returns for different investment categories from 1998 - 2017.

I know it's difficult to see exactly what's going in this chart. The different colors represent different categories of assets. For each year, the best-performing assets are at the top of the page and the worst-performing assets are at the bottom. As you can see, it's rare for the same category to consistently be number one - or two.

Superhero portfolio assemble!

Okay, we've established why having one superhero (stock) isn't ideal. The following chart shows a hypothetical portfolio comprised of five superheroes (stocks). Please note the stocks referenced here provides a highly simplified illustration of how diversification works.

Spoiler: Instead of a 20% loss, you have a 3% gain.

Congratulations, your superhero stocks have saved the day! Instead of a 20% loss, you have a 3% gain!!

Simplify!

For the average investor, owning a portfolio of individual stocks, such as the one in the example above, isn't practical. Fortunately, mutual funds and exchange-traded funds (ETFs) provide investors with an efficient, cost-effective means of holding large baskets of stocks and bonds.

Key takeaways

Owning one stock (or having Iron Man on your side) is great, but it's risky and could lead to losses (or the end of the world). On the other hand, owning multiple stocks in different categories (or multiple superheroes) typically reduces risk and leads to better long-term returns (or the world not ending).

I've just proven that reading comic books or watching movies based on comic books is not a waste of time. Thanks, Stan Lee!

Image credit goes to my awesome cousin, Bryan Lenning. You can (and should) see more of his work at instagram.com/bryanlenning

Investing Is Hard

When I say "investing is hard", what I really mean is that staying invested is hard. Especially when the year's gains are wiped out in one day, which happened earlier this week. Or when you are bombarded by non-stop financial information, much of it negative, from many sources. Or when you can log in to your financial accounts anytime you want and watch the value decrease.

For investors of all ages, 2018 has been a difficult year. It has been a long time since investors have seen such wild swings in financial markets. Since 2009, staying invested has been easy. Sure, there have been ups and downs, but mostly ups. And the market always goes up, right? Wrong, but after 10 years we've become accustomed to positive returns.

Check out this chart:

The chart shows the total annual return for the S&P 500 since 2009. Obviously, 2018 isn't over yet, so there's time for the bar to go in either direction.

The takeaway from the chart is that we've had a great run over the 10-year period shown above.

I could tell you to stop checking the value of your investments, but you won't do that. Technology has made it easy for us to quickly log in to our accounts or receive automated notifications of the balance, performance, etc.

I could tell you to ignore the daily news about the financial markets, but you won't do that. There's information everywhere and it's nearly impossible to avoid.

I could tell you not to listen to talking heads make predictions about what the markets will do, but you won't do that. Like daily news about financial markets, it's almost impossible to avoid hearing from someone who knows what's going to happen in the financial markets today, tomorrow, or next year. Here's a secret: No one can predict, at least not consistently, what's going to happen.

You're human, at least I think most of you are, which means you will worry about your investments, you will be curious about the day-to-day changes in your account, and you will want to know what's going to happen to your accounts in the future.

Do one more thing, the hard thing: Stay invested.

Listening / Reading / Watching

Here's what has my attention right now:

Red Dead Redemption 2 by Rockstar Games. It's like Westworld minus the violent, bloody robot uprising! The original Red Dead Redemption is one of my favorite games of all-time, which means I've been eagerly anticipating the sequel. If you're unfamiliar with the Red Dead games, check out the trailer by clicking on the link above. Games have come a long way since Space Invaders and Pac-Man.

Mr. Market's Wild Ride

The Short Version

Greetings! I know you're busy, so I'm going to summarize this post for you:

- Calm down.

- Markets go up and down. It's normal.

- Stop watching and/or listening to what passes for financial news on networks such as Bloomberg, CNBC, Fox Business, etc.

- No one knows why markets rise and fall. Anyone who claims to know is a liar.

- Stick to your financial plan. Don't have one? Get one. You don't have to be rich to work with a financial planner.

The Parable of Mr. Market

The recent ups and downs in financial markets have seriously rattled investors. Well, the downs rattled investors because no one likes the downs. It's not fun watching one's retirement savings or other investments drop in value. Unfortunately, we're stuck with declines because markets don't always go up. Markets are made by people and people are irrational, greedy, and prone to panic.

The market fluctuations and the subsequent flurry of news, analyses, and pundit-speak made me recall the parable of Mr. Market, which Waren Buffett shared with investors in his 1987 letter to shareholders of Berkshire Hathaway. Below, you'll find an excerpt of that letter, which includes the parable of Mr. Market. I used bold text to emphasize what I believe to be the most important takeaway of Mr. Buffet's story. Have at it.

"Ben Graham, my friend, and teacher, long ago described the mental attitude toward market fluctuations that I believe to be most conducive to investment success. He said that you should imagine market quotations as coming from a remarkably accommodating fellow named Mr. Market who is your partner in a private business. Without fail, Mr. Market appears daily and names a price at which he will either buy your interest or sell you his.

Even though the business that the two of you own may have economic characteristics that are stable, Mr. Market's quotations will be anything but. For, sad to say, the poor fellow has incurable emotional problems. At times he feels euphoric and can see only the favorable factors affecting the business. When in that mood, he names a very high buy-sell price because he fears that you will snap up his interest and rob him of imminent gains. At other times he is depressed and can see nothing but trouble ahead for both the business and the world. On these occasions, he will name a very low price, since he is terrified that you will unload your interest in him.

Mr. Market has another endearing characteristic: He doesn't mind being ignored. If his quotation is uninteresting to you today, he will be back with a new one tomorrow. Transactions are strictly at your option. Under these conditions, the more manic-depressive his behavior, the better for you.

But, like Cinderella at the ball, you must heed one warning or everything will turn into pumpkins and mice: Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom, that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence. Indeed, if you aren't certain that you understand and can value your business far better than Mr. Market, you don't belong in the game. As they say in poker, “If you've been in the game 30 minutes and you don't know who the patsy is, you're the patsy.”

Ben's Mr. Market allegory may seem out-of-date in today's investment world, in which most professionals and academicians talk of efficient markets, dynamic hedging, and betas. Their interest in such matters is understandable since techniques shrouded in mystery clearly have value to the purveyor of investment advice. After all, what witch doctor has ever achieved fame and fortune by simply advising “Take two aspirins”?

The value of market esoterica to the consumer of investment advice is a different story. In my opinion, investment success will not be produced by arcane formulae, computer programs or signals flashed by the price behavior of stocks and markets. Rather an investor will succeed by coupling good business judgment with an ability to insulate his thoughts and behavior from the super-contagious emotions that swirl about the marketplace. In my own efforts to stay insulated, I have found it highly useful to keep Ben's Mr. Market concept firmly in mind."

Perspective

Last week, after the markets started bouncing around, I shared a chart of the Dow Jones Industrial Average index on my personal Facebook feed. I believe it's worth sharing again.

The Dow Jones Industrial Average index over the last 10 years.

I don't want to come across as cold and uncaring. Fluctuations in markets can have serious financial consequences depending on how much you have saved as well as the stage of life you're in. The best thing you can do is create - and stick to - a financial plan because no one can predict why or when markets will rise and fall.

Listening / Playing / Reading / Watching

Here's what has my attention right now:

- Neverwhere, by Neil Gaiman. In a previous post, I mentioned how much I enjoyed listening to Gaiman's American Gods. I highly recommend Neverwhere, too. Bonus: Gaiman narrates the audiobook edition and his performance is fantastic. I would listen to him narrate the phone book. If phone books were still a thing.

- Morning Star, by Pierce Brown. I'm pretty sure Brown's series is considered YA (young adult) literature and I don't care. Morning Star, which is book three in the Red Rising trilogy, is just plain fun. If Greek mythology, The Hunger Games, the Harry Potter series, and Game of Thrones had a baby, it would be the Red Rising trilogy.

Post-Election Thoughts

What Happens Next?

I know many of my friends and clients were surprised by the results of last night's election. Adding fuel to the fire, it didn't help that markets fell sharply as reactions to a Trump presidency spread across the world. The Dow was off over 800 points, more than a 5% decline, and futures trading on the S&P 500 temporarily halted.

The results of the election and its impact on financial markets will be discussed adnauseum in the coming days (well, probably weeks). The topic of incorrect polls is likely to come up, which is understandable because, in addition to the US election, polls for the Colombia-FARC peace deal and Brexit were wrong. Just remember that markets calmed down quickly after the Brexit vote rocked financial markets. In fact, it's now about 11:30AM EST and US markets have already stabilized - and are in positive territory.